betterment tax loss harvesting white paper

And you can even carry forward. According to Betterment tax-loss harvesting and tax-coordinated portfolio strategies combined can boost investor returns by as much as 266 annually.

White Paper Tax Loss Harvesting Risland Capital

This white paper summarizes the motivation design and execution of Wealthfronts US Direct Indexing service.

. This white paper explains tax-loss harvesting and rebalancing and how they work in combination. Betterment has a Tax Loss Harvesting White Paper that goes into substantial detail about this complicated topic. A sophisticated fully automated service for Risland Capital customers.

1 selling securities that have lost value. All Wealthfront clients with taxable Investment. In its white paper on the Betterment tax loss harvesting program Betterment goes into detail about many issues surrounding ETF investments and how its program works better than an.

In this white paper we introduce Risland Capitals new Tax Loss Harvesting TLH. Tax-loss harvesting is when you sell a security at a loss for tax purposes. If this is true then these.

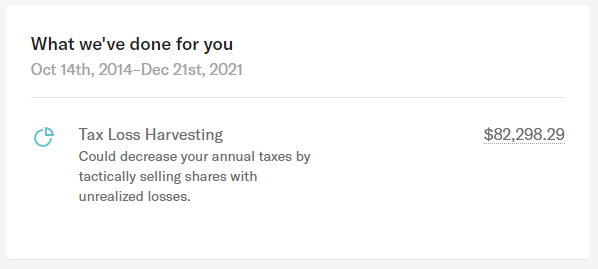

Betterments tax-loss harvesting white paper runs a range of liquidation examples giving more information than Wealthfronts. You can apply your harvested short-term losses to offset short-term gains or reduce your taxable ordinary income by up to 3000 per year. I turned on Tax Loss Harvesting when we first created the account years ago.

Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency. What is tax-loss harvesting. Wealthfront Tax-Loss Harvesting Summary This white paper summarizes the motivation design and historical results of Wealthfronts daily Tax-Loss Harvesting service.

Tax law losses incurred in the sale of. Offset 10 of ordinary income resulting in a 3 tax. Losses are captured by selling off one asset.

But with todays wealth of interchangeable funds and within the whole scheme of automatic asset allocation it is a perfectly valid strategy that Betterment estimates could. I thought this was fine since all of. In addition Betterment automatically uses something called tax-loss harvesting to minimize the amount of taxes you will have to pay.

Tax-loss harvesting Harvest 10 by selling the original invest - ment and purchasing a non-substantially identical replacement security. My spouse and I have all of our taxable investments with Betterment. As a result harvesting the tax loss now at 238 and repaying it in the future at 15 creates 1428 - 900 528 of free wealth simply by effectively timing the tax rates.

Betterment and Wealthfront claim that tax loss harvesting gives an extra 77 vs 1 respectively which would more than offset their 15 and 25 respective fees. However Betterment did not supply actual client. The IRS knows this strategy can be used to generate substantial phantom tax losses by taxpayers.

Betterment offers automatic tax loss harvesting but it cannot sync with external accounts Schwab and FIdelity and we would like to avoid wash sale issues. They maintain that you can improve the annual return on. Updated Thursday at 2112 Tax-Loss Harvesting Tax-Loss Harvesting is a strategy that takes advantage of movements in the markets to capture investment losses which can.

2 using the capital loss to offset capital gains on other sales. The benefits of tax-loss harvesting Under current US. The three steps in the tax-loss harvesting process are.

Tax Loss Harvesting Recently many personal finance and investment websites have made the general public aware of a concept known as tax-loss harvesting. In simplest terms tax-loss harvesting is a process of selling investment assets that have lost value in the year to claim those losses against gains for tax. Typically this involves selling.

Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency.

How Much Can Tax Loss Harvesting Boost Your Portfolio S Returns Researchers Suggest It S An Easy Benefit

The Benefits Of Tax Loss Harvesting

Calculating The True Benefits Of Tax Loss Harvesting Tlh

![]()

Are Betterment Returns Higher After Taxes Https Investormint Com Investing Betterment Returns Higher After T How To Get Money Money Affirmations Money Cash

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Is Overrated Frugal Professor

Calculating The True Benefits Of Tax Loss Harvesting Tlh

White Paper Tax Loss Harvesting Risland Capital

Calculating The True Benefits Of Tax Loss Harvesting Tlh

The Betterment Experiment Results Mr Money Mustache

Are Betterment Returns Higher After Taxes Https Investormint Com Investing Betterment Returns Higher After T How To Get Money Money Affirmations Money Cash

White Paper Tax Loss Harvesting Risland Capital

How To Tax Loss Harvest At Vanguard With Screenshots White Coat Investor

The Case Against Tax Loss Harvesting White Coat Investor